News

SPRINGFIELD – As the first wave of the 10-year Firearm Owners Identification card come due for renewal, Illinois State Police Director Leo Schmitz is urging FOID card holders to apply…

SPRINGFIELD– The Illinois House of Representatives unanimously approved common-sense pension reform legislation on April 19 sponsored by State Representative Joe Sosnowski, R-Rockford, to allow a municipality to hire a chief…

Our children’s education remains a top priority for Illinois House Republicans, which is why they have taken action to address the growing teacher shortage in our state. First and foremost,…

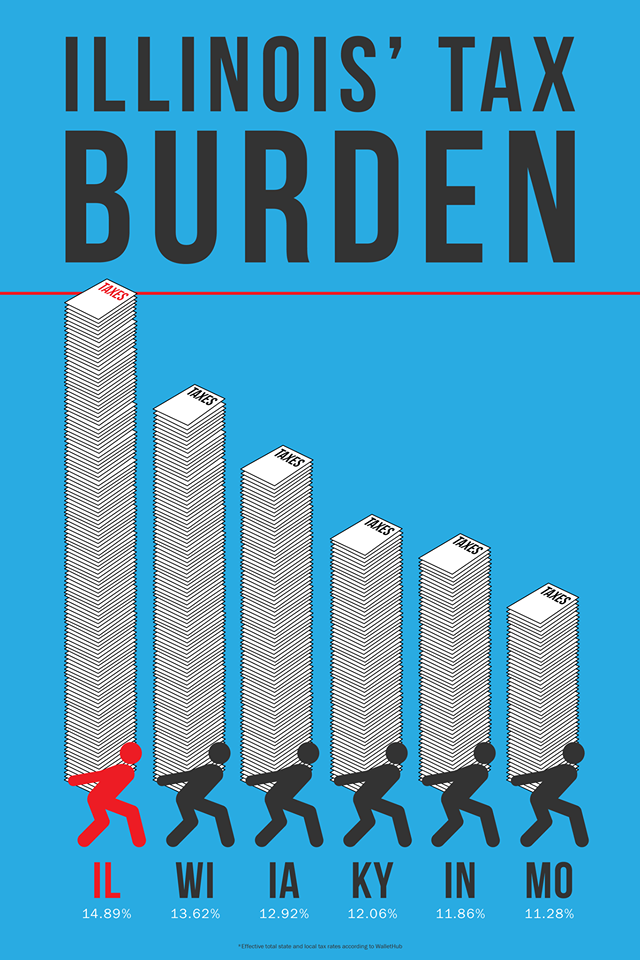

SPRINGFIELD– State Representative Joe Sosnowski, R-Rockford, joined Illinois House Minority Leader Jim Durkin, R-Western Springs, and members of the House Republican Caucus in filing House Resolution 975 on Tuesday to…