News

State Rep. Joe Sosnowski (R-Rockford) participated in the groundbreaking for the new McDonald’s in Rockton on Wednesday. The new restaurant will be at the corner of Rockton Road and Quail…

By Scot Bertram | Illinois News Network A new law is designed to protect Illinois consumers from years of back-billing by local utility providers. State Rep. Joe Sosnowski, R-Rockford, says…

SPRINGFIELD– State Representative Joe Sosnowski (R-Rockford) issued the following statement tonight following final passage of a bipartisan compromise on education funding reform, Senate Bill 1947, which was approved by the…

State Rep. Joe Sosnowski SPRINGFIELD – A new bipartisan law co-sponsored by State Representative Joe Sosnowski (R-Rockford) will enable local school districts to keep more of the federal funds designated…

School choice programs provide families with the opportunity to choose the academic environment that best matches their students’ educational needs, rather than being restricted to attending a school based only…

A new law spearheaded by State Representative Joe Sosnowski will protect consumers from being back-billed for years of local utility charges caused by the utility’s own error. House Bill 3400,…

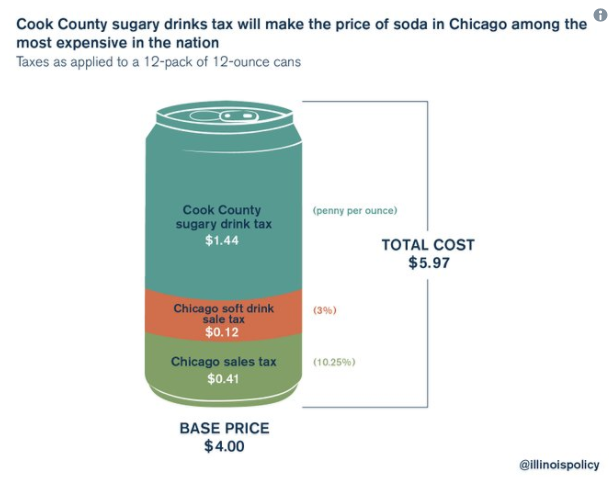

State Representative Joe Sosnowski (R-Rockford) is sponsoring new legislation to repeal the costly Cook County “pop tax”. Rep. Sosnowski this week joined a number of his House Republican colleagues calling…

Today Rep. Joe Sosnowski (R-Rockford) joined with community members to welcome Aunt Martha’s new Rockford Community Center at Swedish American Hospital. Aunt Martha’s continues to set a remarkable example of…

Rep. Joe Sosnowski (R-Rockford) hosted a coffee talk at Sophia’s Restaurant in Roscoe this morning. Special thanks to all those who were able to attend. Rep. Sosnowski appreciated your questions…

State Rep. Joe Sosnowski We already have an overly complicated funding formula that is near impossible to explain to the average Illinois resident. The newly proposed evidenced-based formula, Senate Bill…